Retirement savings accounts such as the 403(b) and IRA are great ways for public school employees to set aside money for retirement.

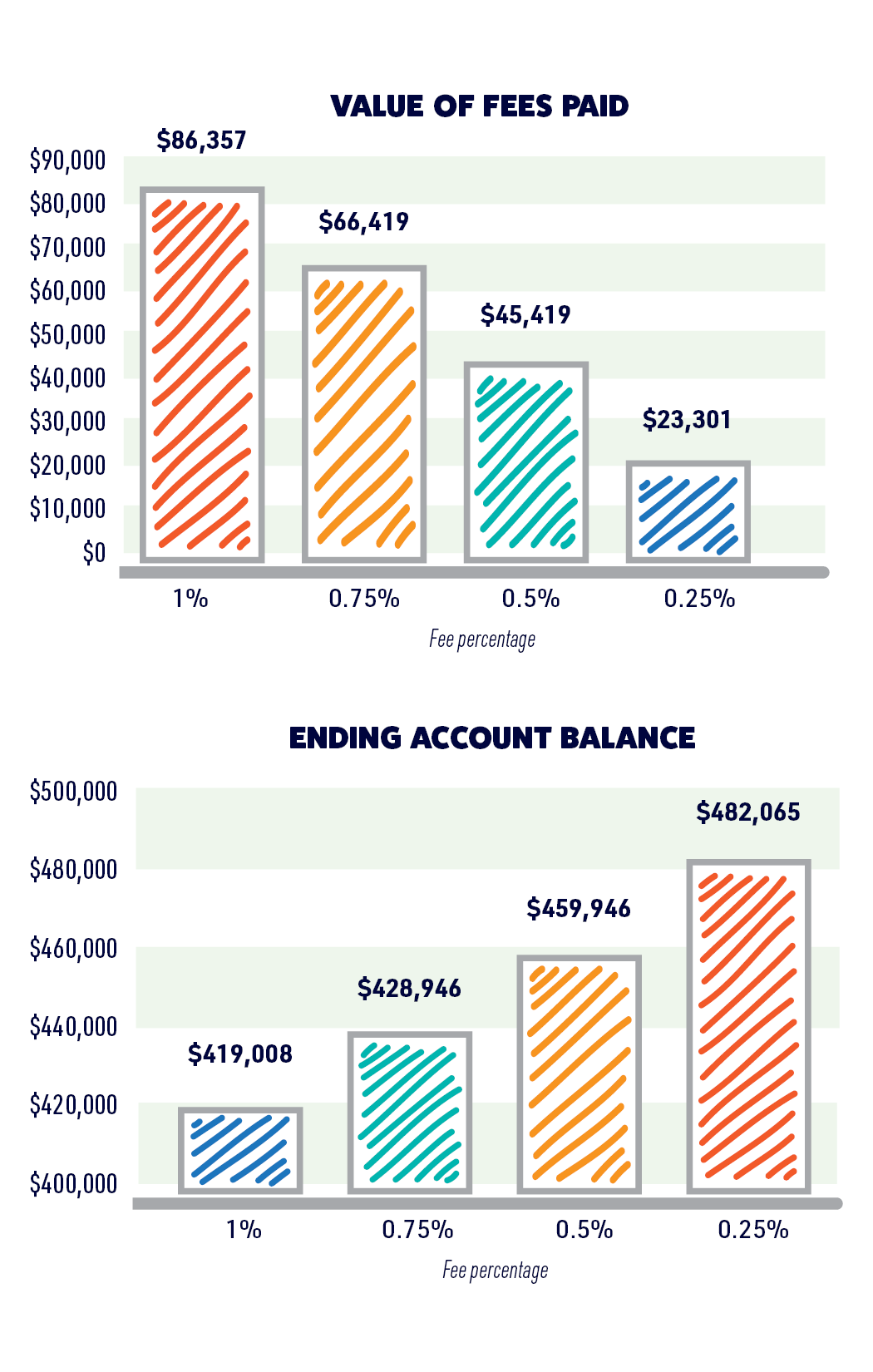

However, fees charged by some plans can take a big bite out of your earnings. The illustration below compares the impact various fee scenarios can have on your savings over time. In addition, we’ve compiled list of the most common fees that can affect your 403(b) and IRA returns.

Illustration assumes an annual contribution of $5,000 and an annual rate of return of 7% over a period of 30 years. This is for illustrative purposes only and not indicative of any investment.

The 403(b) retirement plan is offered by the WEA TSA Trust. TSA program registered representatives are licensed through WEA Investment Services, Inc., member FINRA. The Trustee Custodian for the WEA Member Benefits IRA accounts is Newport Trust Company.

Disclaimer

The information provided is referencing investments in 403(b), Traditional IRA, or Roth IRA accounts and is for informational purposes only. It does not take into account your risk tolerance, time horizon, or investment objectives. Please note that mutual funds may assess contingent deferred charges on withdrawals that have not been on deposit for a set period of time described in its contract or prospectus. Your account will also be taxed and penalized on withdrawals prior to reaching age 59½. The taxation on the various listed accounts will vary and should be taken into consideration carefully when deciding on an account. Please consult your professional tax advisor prior to taking any withdrawal. The WEA TSA Trust, WEAC IRA, mutual funds, and other investment products have varying degrees of risk and should be considered carefully prior to investing. This example assumes a 7% rate of return net of any other applicable fees such as mutual fund operating expenses. For example; A mutual fund with a 7.50% return and an 0.50% expense ratio would net a 7% rate of return. Investments in mutual funds and other investment products are subject to investment risk and its principal is not guaranteed. Please review the prospectus carefully prior to investing.

FEES DEFINED

The number one factor in determining your rate of return—after asset allocation—is cost. Fees can significantly impact your retirement account over time. Don’t worry! Member Benefits is here for you! Below is a list of fees commonly charged by many investment providers on retirement savings products.

NOTE: Member Benefits DOES NOT charge any of these fees.

Mortality and expense (M&E) fee

A percentage fee imposed on the investor to protect the insurance company against the risk of the account holder living longer than projected or the company’s expenses being greater than expected.

Commissions (Loads)

A sales charge paid when an individual buys or sells an investment. There are two main types of commissions or loads:

- Front end: A front-end load is a fee that is charged when you buy shares of a mutual fund. This fee is a percentage of the total amount you invest, and it is deducted from your initial investment.

- Back end: A back-end load, also known as a deferred sales load or redemption fee, is charged when funds are withdrawn or transferred before the end of the holding period.

Custodial fee

One of the primary functions of a custodian is to hold and safeguard your investment assets. Custodial fees may cover the costs associated with maintaining the security of these assets, such as stocks, bonds, or other investments.

12b-1 fee

This charge generally allows fund companies to compensate broker/dealers for selling their funds, with a payment to the representative who sold the fund. This fee is also used to cover the marketing and distribution costs of the investment.

Annual contract charge

A fee charged by a vendor for administrative expenses.

Surrender charge (Withdrawal charge)

A fee charged by some annuities when an investor takes money out of his or her account before a minimum amount of time has passed since the initial investment.

Wrap account fee

Charged by a personal financial advisor, this fee is expressed as a percentage of the client’s assets under management. and is deducted from account assets.

For help determining what fees you pay with your current vendor, call a Member Benefits Retirement Consultant at 1-800-279-4030.

For help determining what fees you pay with your current vendor, call a Member Benefits Retirement Consultant at 1-800-279-4030.

Created by educators

WEA Member Benefits

Over 50 years ago, we were created by Wisconsin educators for Wisconsin educators. No other financial organization can say this. Explore our unique programs and services.