In 2010, Nick Havlik was 24 and an extreme saver, putting as much as 40% of his income into retirement savings. (No, that’s not a typo!) He was focused on the retirement long-game and committed to saving upfront to maximize the impact of compound interest and increase his chances of an early retirement. As he said then, “I’m saving now so I have more freedom later. I don’t want to have to work part-time in retirement to supplement my income.”

Nick’s approach is solid and based on sound financial practices. Andrea (Andie) Hartwig, WEA Member Benefits Financial Planning Consultant, agrees that saving as early as possible and saving as much as you can will help ensure a financially secure retirement. “However,” she says, “Nick is a saving anomaly. The idea of saving forty percent of your income, while admirable, probably isn’t going to work for most people,” she says. “What is important is to start saving something—even a small amount—as soon as you can.”

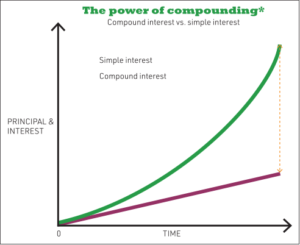

Time, she says, is your greatest asset—something Nick understood early on and took to heart. “It allows you to maximize the benefits of compound interest. Contributions will grow and grow over the years, earning interest on interest on interest. Even small contributions can make a significant difference down the road,” Andie explains. And Nick has used his time wisely.

Catching up with Nick

Twelve years have passed since we last talked with Nick. One has to wonder how long a 24-year-old can continue such a rigorous regiment of saving—a regiment, Nick said at the time, that others considered a little crazy, unreasonable, or impossible to maintain with all the temptations dangled in front of fresh-faced 20 somethings with so much life to live.

Andie adds, “It’s especially hard for young educators to plan for a retirement that is decades away because there’s a lot of competition for the earned dollar. They typically have student loans, they’re trying to launch their career, they’re setting up a place to live and the expenses that go along with that, and perhaps buying a car. And then there’s a social life that may vie for a piece of the pie…restaurants, concerts, and trips. Later it might be a wedding, a house, and kids. It’s a lot to manage.”

So, the big question now is: Was Nick’s approach sustainable? How committed has he been to his plan? To feed our curiosity, we checked in with Nick to see what his life looks like 12 years later.

Tending to his grapes…and his plan

We tracked Nick down not in a classroom, but in a vineyard. No, he wasn’t on a wine tasting tour. He was working…in his vineyard. This is where he spends most of his summer, between rows of grapevines, tending to his crop. Nick still teaches—now with the Port Washington school district—but he says, “I’m essentially a farmer as well.”

The vineyard is the result of a decision to stop working for other people during the summer. “It’s all part of the plan,” he says, the same plan he had at 24—retire early. Only now it’s a plan he shares with his wife, Andrea, and together they’ve made a few tweaks.

“There was an opportunity and we took it. In 2014, we planted our first vines—just 500—and now we have 5,500. Small local vineyards are increasingly popular,” he says. And he’s right. According to the Wisconsin Winery Association, in 2000 there were fewer than 100 acres of vineyards planted. In 2019, it was well over 1,000. The number of Wisconsin wineries also increased from 13 to 110 in that time. “There’s a market for the grapes right here in Wisconsin,” Nick adds.

The sooner you start planning, the better your odds of retiring with the money you’ll need to enjoy it.

Evaluating risk

When asked about the risk of the venture, Nick doesn’t hesitate. “Like farming, it’s a risky business for sure. We could get one hail storm and lose it all. But life is full of risk. The best you can do is prepare for it. We would be distraught if that happened, but financially, we would be fine.”

Risk is part of the investment equation. All investments carry some degree of risk. “The key is knowing what the potential loss is, what that might mean for our situation, weighing it against the potential for gain, and then deciding what we can stomach,” he says.

Like most investments, the vineyard wasn’t an instant money-maker. “We didn’t make a penny for three years. And what we did make went back into the vineyard. But it’s what we expected,” he said.

He worked the vineyard for two years while still teaching and living in Brookfield, but in 2016 he and his family moved to Port Washington. “It was a good move. I really like the district. Financially, it made sense and it’s closer to the vineyard, which is in Fredonia.”

Balancing compound efforts

In addition to the vineyard, Nick and his wife Andrea have dabbled in a few other ventures to help toward their goal. As one can imagine, he is busy all the time—also part of the plan. “I’m 37. We only have so many years to continue at this pace. Too many people live by a ‘work to grave’ concept. Our plan is to get the time back later by putting the time in now. At this point, we have a ten-year window to stretch ourselves. Time is our biggest asset,” he emphasizes.

In addition to the vineyard, Nick and his wife Andrea have dabbled in a few other ventures to help toward their goal. As one can imagine, he is busy all the time—also part of the plan. “I’m 37. We only have so many years to continue at this pace. Too many people live by a ‘work to grave’ concept. Our plan is to get the time back later by putting the time in now. At this point, we have a ten-year window to stretch ourselves. Time is our biggest asset,” he emphasizes.

Some might think Nick’s life balance is out of whack, but he assures us that is not the case. He is married with two young daughters. “I’m 100% satisfied with my life balance. My number one priority is to raise good, happy, successful kids. I always make time for my family. We sit down for supper every night as a family.

“There are times when it’s go, go, go, but then it slows down,” he says. “For example, September stinks. I work every single day at the vineyard during harvest. But then things settle down a bit.”

He admits to missing out on some things he enjoys, like fishing. “I love to fish, but I don’t have time. I’m banking time for that in the future.”

It’s hard to imagine Nick slowing down too much in retirement, but then, his notion of retirement may not match up with most. “The word retirement may be out,” he suggests. “Maybe it should be changed to ‘finding your second calling.’” Thus, the vineyard—but he’s hoping he won’t be doing all the work at that point.

Financial partnership

Nick says none of this would be possible if he and his wife weren’t in lockstep when it comes to finances. “We have the same goals and we have conversations regularly about our finances. It’s a partnership.”

It turns out that having a financially compatible spouse makes for a strong marriage. Studies show that opposing attitudes about money, conflicting priorities and goals, and different spending behaviors are among the top reasons couples divorce (2019 Ramsey Solutions study).

“I wouldn’t be where I am without her. Marrying my wife was the best financial decision I’ve ever made.”

Get yourself a plan

And so it seems that Nick has remained committed to his original plan: Do what it takes to retire early. “Nick offers good tips for building financial security,” Andie says, “but most people won’t likely practice them with the fervor and discipline that he has. Everyone’s circumstances are different, as are their retirement goals. How much you need to retire depends on many factors: when you retire, your lifestyle, and what you plan to do in retirement. Will you travel? Do you have expensive hobbies? Additionally, will you retire with debt, like a mortgage? And, don’t forget about health insurance costs before Medicare kicks in. If you are not planning to step out of the workforce early, a less rigorous approach may work. In any case, everyone should have a retirement plan.”

If you don’t have a plan or want to review your current plan, remember you have a resource at Member Benefits. Our financial planning services are designed to fit your style and needs—including Do It Yourself, Financial Coaching, and Financial Planning Advice. “The sooner you start planning, the better your odds of retiring with the money you’ll need to enjoy it.”

Andie is quick to point out that even if you didn’t start saving with a 403(b) or IRA as early as Nick, it doesn’t mean you can’t start now. She encourages public school employees of any age to focus less on the amount they can save right away and more on getting started. “If you haven’t started saving, don’t wait any longer. Make today the day,” she emphasizes. “Increasing contributions when you can is important, but getting started is critical because it’s extremely difficult and costly to make up for the lost time.”

As for Nick, it appears he is on track to becoming financially secure and making his early retirement dream come true. With any luck, he’ll be enjoying the fruits of his labor, and maybe a glass of wine, while someone else tends to his grapes.

Nick’s financial credo

The credo by which Nick and his wife Andrea operate is fairly simple…and it hasn’t changed much in 12 years.

We don’t overextend ourselves. It has nothing to do with how much you make, it’s about choices and priorities. We don’t take extravagant vacations, and I’m driving a 2000 Buick.

We save and plan like there will be no Social Security and no pension when we retire. We fully fund our retirement accounts. It’s probably the most important thing you can do.

We try to live frugally. We don’t try to keep up with the Joneses. It’s an easy trap to fall into.

We don’t take risks we can’t recover from. You have to understand the risks you are taking and what the impact of loss would be on your finances.

Get more of the story!

Read the original story about Nick and how saving big for retirement and taking advantage of compound interest put him ahead of the game. View the Summer 2010 magazine.

We’re here for you

Learn more about Member Benefits’ programs and services by exploring our website or calling 1-800-279-4030.