Fifty years ago, public educators in Wisconsin gained access to programs that would be instrumental in securing their financial future.

What is known today as WEA Member Benefits—with its broad array of financial education, services, and products—began operation in 1972 with a single program that was based on a big idea: that public educators deserved to be financially secure and that the value they brought to our communities should be reflected in programs that protected and empowered them financially.

We will celebrate that milestone—a half century of serving Wisconsin public school employees—throughout 2022 with some “where are they now” stories of members who have been featured in your$ magazine since we began publishing it in 2009. In visiting with them again, you’ll learn how their lives have changed, what challenges and successes they have had, and what role Member Benefits has played in their journey toward financial security.

Passing the torch: A legacy of education and financial security

Leatrice Jorgensen’s story has been a favorite, and it seems appropriate to start this year of celebration and reflection here because it’s a story rich with a passion for learning and teaching, tradition, and connection to the early days of Member Benefits.

It was 2010 when we sat with Leatrice at her kitchen table flanked by her daughter and granddaughters. The table, she said, was a gathering place for family fun and making memories. It was also a place for learning, counseling, and legacy building.

Leatrice caught our attention when she called asking for 403(b) enrollment forms to be sent to her granddaughter Amanda, who was a new teacher. This was the second time Leatrice had made this call. The first was when Amanda’s older sister Lea started teaching several years earlier. The goal was to have both granddaughters start saving for retirement right out of the gate. She knew from experience the significance of this decision and what it could mean for their financial future.

Leatrice first opened her 403(b) account (what was then called a tax-sheltered annuity account) in 1981 when the WEA TSA Trust consisted of just a guaranteed or “fixed” investment and the interest rates were high. “I think I’m going to get into that,” she told us she had announced to her husband at the kitchen table. “He wasn’t so sure.” But Leatrice felt she needed to get started right away and opened an account. Her intuition paid off. “We did quite well,” Leatrice reported.

The more things change

Of course, a lot has changed since she opened her account. Today, the financial products and services offered by Member Benefits have expanded to include the option for mutual fund investment, Roth savings, IRA accounts, and financial planning services. There is even a nonretirement savings account option. Additionally, over the decades there have been changes in economic conditions, the financial regulatory environment, and the technology that drives it all.

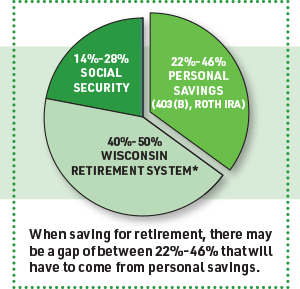

What hasn’t changed, however, is the need to save. In fact, saving is more important than ever. For many public school employees, it’s likely that their state pension and Social Security will not be enough to cover living expenses in retirement.

And, concepts like the time value of money and compound interest haven’t changed either. Leatrice knew that starting early would give her granddaughters an edge because they have time on their side. She was right.

The story continues

Eleven years later in 2021, we pick up Leatrice’s story at the same kitchen table where Amanda, Lea, and Patti are gathered. The kitchen is unchanged, but there is an empty chair. Leatrice passed away in 2016. She was a breast cancer survivor, her daughter Patti says, but succumbed to ovarian cancer in 2016.

For Amanda, Lea, and Patti, life has marched on, but the memory of Leatrice and what she taught them is ever present in their lives.

Amanda

Amanda Gabryszek is now in her thirteenth year at Bay Port High School in Howard Suamico. She teaches culinary arts classes. “I truly love it,” Amanda says. Leatrice dubbed Amanda the family gardener and chef because she used grandma’s kitchen to try out new recipes for the family and the classroom. “Grandma’s kitchen is still the test kitchen, and we gather here for holidays and weekend fun.”

Amanda acknowledges her Grandma’s influence is evident in many aspects of her life, even in the classroom. “I talk about her to my students when I’m teaching certain skills or recipes. For instance, she taught me how to make pie crust. At Thanksgiving, I got to roll out the leftover dough scraps to make mini-pies. I share this tradition with my students so they can see how something so small can have a huge impact in your life.”

Each year, her students do an activity around the importance of their journey with food—how their family eats, how it impacts them, and recipes their family values. “We talk about money, too: budgeting, grocery shopping, and costing ingredients,” she says.

Financially…

Amanda continues to contribute to her 403(b) and plan for her future. “I followed Grandma’s advice. She wanted us to learn to live and support ourselves while saving for the future. It feels great to be able to do that!”

Most important financial decision since 2009

Increasing her 403(b) contribution each time she got a raise or payment for extra duty. Increasing contributions when your salary goes up was one of the strategies Leatrice implemented and preached. “That was always Grandma’s best advice on financial planning!”

This was great advice from Leatrice. She knew that it’s the little things in life that can make the biggest difference.

Greatest financial challenge

Understanding finances with a spouse. She married her husband Chris two years ago and concedes it took some adjusting to the new dynamic. “I didn’t really think about it too much until we were making decisions like purchasing a house, combining bills, and such.” But they are figuring it out together—the day-to-day and the long-term planning for retirement. “We are mindful about where our money goes in our giving, spending, and saving.” Leatrice would approve.

Lea

Lea Hanke taught 4th grade then switched to 7th grade health at Marshfield Middle School before deciding to take a break. “With three daughters, ages 6, 3, and 6 months, life is much different now,” Lea says. “I decided this summer to step away from teaching for now. I really want to be there fully for my girls,” she says. “I hope to expose them to a wide range of things and experiences like Grandma did for me.”

The decision to take a break was not an easy one for Lea and her husband. “My salary increased greatly in the past 11 years with the completion of my Master’s degree and additional professional development opportunities, so to give that up was a huge decision,” she says.

Parenting is emotionally rewarding and fulfilling, but leaving the workforce to be a stay-at-home parent, as Lea suggests, generally has some financial implications for the family budget and long-term financial plans. It not only means loss of income but also other benefits, including access to your employer’s retirement savings plan or pension, loss of contributions and years of credits to Social Security benefits, and missed opportunities for career advancement.

This doesn’t mean that staying at home to care for your kids is wrong or impossible, nor should it be discouraged. The key is to understand what it means for you and plan for it.

Financially…

Like Amanda, Lea also heeded her grandmother’s advice to increase contributions to savings. “I contributed and increased my 403(b) contributions like Grandma wanted me to when my pay increased,” Lea says.

As Leatrice explained it, “You didn’t have that money before and were able to live without it, so redirecting it to savings right away is an easy way to pay yourself first.”

Greatest financial challenge

Trying to budget during the summer months. “I didn’t have the option to get paychecks over the summer, so it was a struggle. We always had more time to do things but not as much money to do them and still pay our bills.”

Greatest financial decision

Stepping away from teaching to care for her three young daughters. “We know the decision will impact the long-term plan, and it may mean our retirement may not be as soon as we had hoped, but we felt it was the best choice for our family at this time.”

Patti

Teaching is also on the resume of Leatrice’s daughter, Patti Hilger. She taught 4th, 5th, and 6th grades in the Merrill School District for eight years. She loved teaching, but like Lea, she quit to raise her girls. A tough decision but not one she regrets.

Patti fondly recalls the atmosphere of learning her mother created for the family. “Learning was continuous in our home. My earliest recollections of Mom are watching her sit at the kitchen table each morning to plan her day, study and plan her lessons, pay her bills, and talk over life.”

Leatrice’s decision to open and fund a 403(b) account not only provided Leatrice with additional income in retirement, but continues to provide a source of income for Patti and her sister.

“We now receive the required minimum distributions each year from Mom’s account. Mom knew enough to place every raise she received into her 403(b) and promoted the program all of her days. She also took advantage of workshops offered and shared what she learned with fellow educators. Our girls both listened and direct their raises into their accounts, and my husband and I do the same in our retirement plan at our business. But I didn’t heed her advice during my teaching years and I still regret it,” Patti says. “Mom had the wisdom and knowledge to allow her money to work for her throughout her seasons of life. And we are benefiting from that wisdom.”

Patti describes Leatrice as a loving, energetic, fun-loving, hardworking, dedicated, compassionate woman. “She stepped out of her comfort zone throughout her life and became somewhat of a trailblazer for women. She felt strongly about the need to get a quality education for children and herself.”

When Leatrice became ill, Patti stepped in as caregiver. “Mom was a great patient and we laughed and enjoyed our time together to the end. Her middle name was ‘Joy’ and she truly was a joy. I am grateful for the time I spent with her and encourage others to choose to care for their parents whenever possible.”

Leatrice left her family a legacy of learning and teaching, love and caring, and wisdom that by all accounts has the momentum to benefit generations to come.

Get more of the story!

Read the original story about Leatrice and how her passion for learning and teaching was passed down the generations. View the Fall 2010 magazine (online or PDF).

Ready to save more?

Enroll in our 403(b) or IRA retirement savings programs by visiting our website or calling 1-800-279-4030.