Welcome Madison Teachers Inc. members!

Enroll in the 403(b), find retirement savings information, and book a financial consultation.

Enroll in your district’s 403(b) retirement savings plan

Start saving for your financial future.

Book a FREE financial consultation with a Member Benefits Consultant

We are here for you to and through retirement.

Are you properly insured?

The coverage insurance provides is an important part of your financial health. You work hard for what you have, so protect it with someone you can trust like Member Benefits. Our discount programs and payment options make managing costs and budgets easy.

Explore our insurance products to cover your home, auto, and more.

Get expert help!

Having a financial plan helps you see the big picture, set goals, and stay on track, whether you are just starting your career or planning your exit. Get a plan for your future by making a financial planning appointment with one of our financial advisors.

Complimentary and fee-based services are available.

Save for your future.

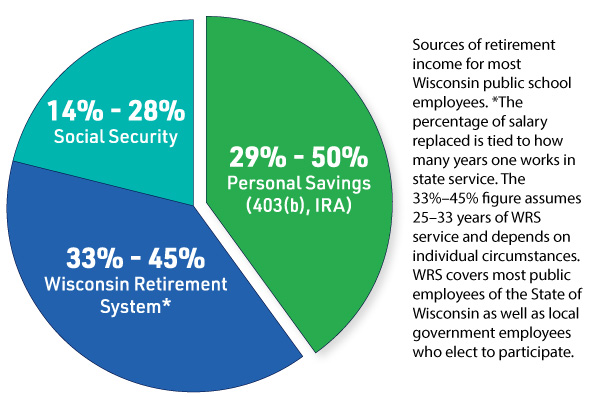

Most Wisconsin public school employees will need more than Social Security and their pension in retirement—the rest is up to you.

WEA Member Benefits' Individual Retirement Account (IRA) options and nationally-recognized 403(b) retirement savings program are great way to save for retirement.

Discounts for MTI members!

Created by educators for educators over 50 years ago.

Created by educators for educators over 50 years ago.

Member Benefits offers educator-focused insurance coverages with flexible insurance payment options and discounts on financial planning services.

Bundle your home and auto insurance and save!

Resources

Member Benefits works with public school employees to guide and provide resources along their financial journey. Below are a few our most requested resources available for download.

Retirement Comparison Flyer

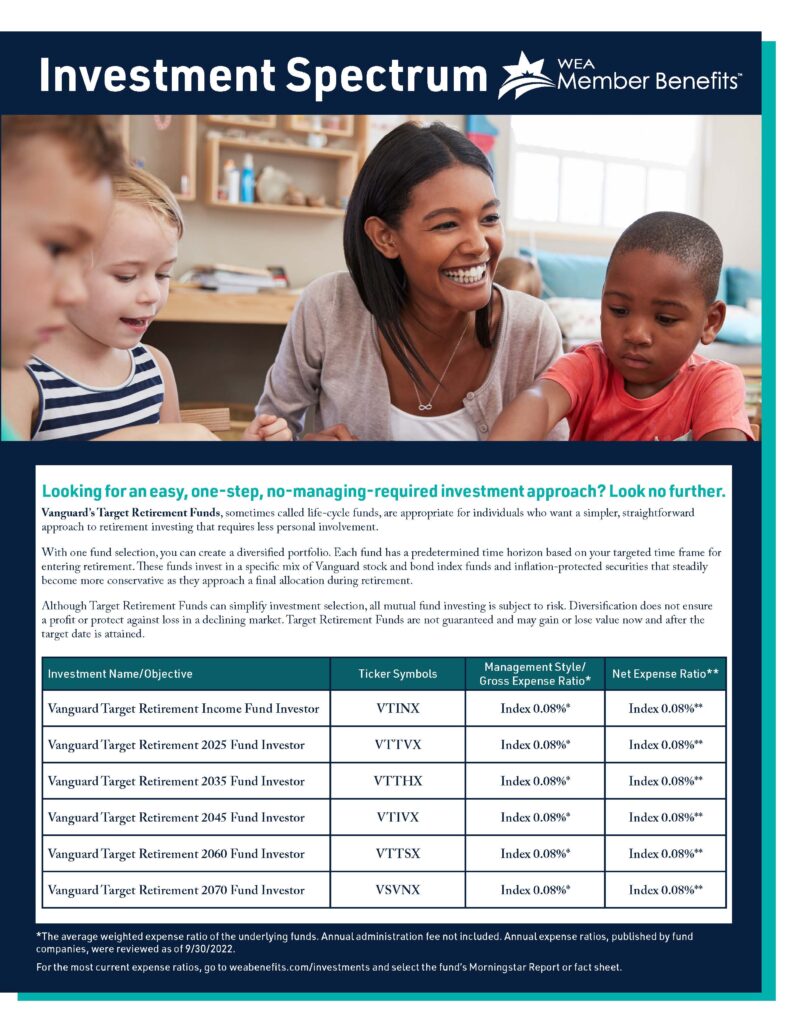

Investment Spectrum

How to Fund Your Account Flyer

403(b) Enrollment Booklet

Quarterly Performance Report

Unlock Your Savings Potential

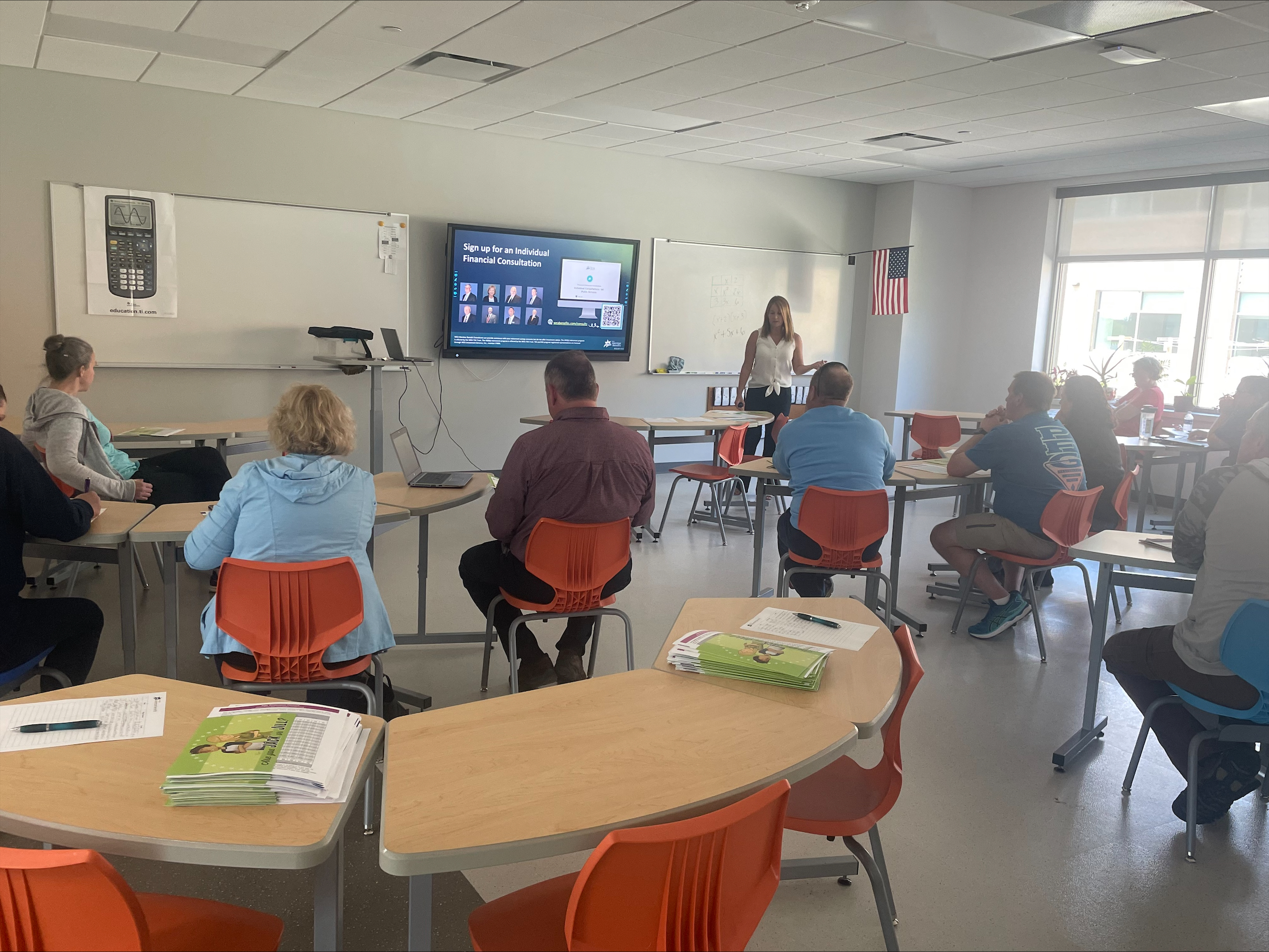

Ask us about our seminars!

Providing financial education is just one of the ways we support our members to and through retirement.

We offer a variety of seminars tailored to meet the needs of Wisconsin public school employees. Seminar topics we offer include retirement planning, WRS, budgeting, personal insurance, and much more. Visit our seminar descriptions page for details.

If you have questions and/or are interested in bringing one of our seminars to your district, please reach out to our team via email.

In-person and virtual seminar options are available.

Created by educators

WEA Member Benefits

Over 50 years ago, we were created by Wisconsin educators for Wisconsin educators. No other financial organization can say this. Explore our unique programs and services.