Q&A with Joanna Rizzotto

The first thing you notice about Joanna Rizzotto is her smile. You can’t help but be drawn in. She is shrouded in an aura of positive energy.

It’s been five years since the last interview, but her hug and cheery greeting are familiar—it’s like meeting up with an old friend. “Your hair! You changed it,” I say. “Always!” she laughs. “I change it up often. My hair is naturally very dark, so it’s a process to get to the lighter color. But once I get to bleach blond, I can easily hop to the fun colors. The kids sometimes make suggestions.”

I discover she isn’t joking about her hair as I look through a brochure she gave me about the REAL Academy—the program that she operates and teaches at in the South Milwaukee High School. In a photo, she is in a circle with her teenage students. She’s the one with purple hair.

And so, our “catching up” begins. The conversation reflects her passion for teaching, love for her students, concerns about her profession, and hope for the future. It’s the perfect prelude to the school year as well as the last in the “where are they now” member-story series we started in January as part of WEA Member Benefits’ 50th anniversary celebration.

How long have you been with the REAL Academy? What is it?

I have been a public school teacher for 27 years and operating the REAL Academy for 11 years. I love it. It’s an alternative program with a holistic approach to learning—we focus on personal well-being and learning and cultivate a safe space where students know they belong and practice healthy communication.

In our last interview, you had such an eloquent way of describing the students (teens) you teach and how you feel about what you do. You said…

“As a high school teacher, I feel honored to work with students during this transitional time in their lives. Teens are largely mischaracterized. I find them to be compassionate, creative, generous, and very curious about the world. I get energy from their thoughts and ideas. Teaching is a very human profession and I’m fortunate to be surrounded by great people.”

…But that was five years ago, and we’ve since had the experience with COVID. Can you speak to its impact? Would your statement be different now?

COVID, of course, had an impact on everything. It provided me and my students the opportunity to really put our skills into practice. As a program that focuses on the integration of well-being and learning—not one or the other—we were able to stay connected as a community, take care of ourselves, and continue growing during the closures. The transition back to school was difficult. We had to regain our stamina—physical and social habits needed tending to.

I still stand by what I said about the students in 2017. I find it fascinating to observe and study how they see the world and respond to it. I can tell you this—they are seeking harmony and connection, and they remind me that “schooling” must be dynamic and relevant.

In 2017, you were very active in the union. Are you today?

Yes. In fact, I ran for Vice President of WEAC this past spring. I did not win, but I came close! Locally and regionally, I am part of my executive boards. I am still focused on membership. I love being a part of my union because we define issues facing public education and develop solutions together.

COVID certainly altered education in the classroom, adding stress for educators and increased financial pressures. What do you see as the greatest financial challenges for educators today?

The greatest financial challenges today are that salaries generally are not keeping up with inflation. Last year the Consumer Price Index was 4.7%. Some districts adjusted salaries to reflect that, but others could not. In my district, my inflationary salary increase was .03%. It’s been 1% or below for the past ten years.

It’s also a concern that teachers are not incentivized to continue their education. Most of my early-career education friends are not pursuing master’s degrees because the cost of a degree outweighs any financial gains they might receive. And sadly, many do not see themselves retiring from education. The financial challenges contribute to the teacher recruitment and retention problem.

Personally, what’s the greatest financial challenge you’ve had in the last five years?

I’ve had three!

- My husband was unemployed for five months during the pandemic. He works as a camera operator for professional sports, and when all the leagues were shut down, so was his source of income.

- Financing our son’s college education.

- My mom developed dementia and I am her primary caretaker. I also provide financial support for her needs which total about $500 a month.

Have you made any financial changes you didn’t expect or plan to make?

Yes. In May of 2020, we refinanced our mortgage to a much lower rate and reduced the term of our loan to generate savings. I also put off buying a new vehicle. I’m still driving my ‘05 minivan with over 200,000 miles on it!

Before COVID, you were instrumental in bringing financial education to your district. You spoke about how important having access to trusted information and programs is for public school employees. You said…

“Time and again, staff had a good experience with Member Benefits, trusted it and had faith in the fact that it was specifically designed to support public school employees. When people come to the Member Benefits presentations, they always walk away feeling hopeful—really feeling good. People who are educators want to be educators. So having this support from an organization dedicated to our profession makes that job easier.”

…But in-person presentations came to a halt for the last two years. Do you expect to bring them back this year? What do you think would be topics of interest?

I can remember the last in-person financial session we had in December of 2019. It was packed! COVID put an end to that. I continued to pass on information within the union and through our district newsletter to colleagues, but we lost a lot of ground in our efforts to help staff feel financially secure.

I’d be open to in-person presentations, although I think most people now prefer anything after school to be virtual. I don’t have a pulse yet on what would be interesting to people. Hopefully, we can find a way to do it.

I always find connecting with Member Benefits helpful and worthwhile. It has this built-in credibility of being for public employees school employees. I still contribute to my 403(b) and am sure to encourage educators to set them up for themselves.

Any new insights or advice for educators today? How about for young people who are thinking about going into education?

We need to reinvest in the human side of education.

Educators today need to support each other and stay connected. When looking for power, don’t necessarily look up the chain of command—look around. Your colleagues understand and will help you.

I still encourage young people to join the profession. We need good people. Our students deserve more great school experiences.

How old are your children now? How have you shared your financial experiences and knowledge with them?

My “kids” are now 21, a senior in college, and 16, a junior in high school.

We share information about saving, budgeting, loans, and saving for retirement. More so with our son because he is close to graduating from college and is more interested. He is responsible for a portion of his educational costs, so he works full-time every summer to meet his obligation.

My daughter will be getting a job this school year and we’re starting to talk about future schooling and careers.

Our kids know that their parents both appreciate the living we have been able to make based on our skill set and education, and that we do not live beyond our means.

What does the future hold for Joanna?

The future looks good. I am grateful to have a happy, healthy family. I plan to continue my career in education and work for improvements that will draw young, talented people into the profession. Things can and will change, if we come together and put in the work.

The fire and the fund

It can happen to anyone. This is what Amy and Spence Wagner learned on April 15, 2020, as they watched their home go up in flames.

It can happen to anyone. This is what Amy and Spence Wagner learned on April 15, 2020, as they watched their home go up in flames.

For two hours they stood outside in the cold with nothing but the clothes on their back, watching as 27 years of memories were destroyed.

The evening of the fire, Amy and Spence were enjoying the company of their son Jake, daughter-in-law Kirby, and Mac, their 3-week-old grandson. Jake and his family were living with them short-term while he awaited the beginning of his medical residency.

“We had just finished dinner. The kids were putting Mac to bed. Spence and I had settled in to watch TV. It was a cold April night, so Spence lit a fire in our fireplace. I recall talking about how fortunate we were that even though the pandemic had closed us in at home, we had Jake and his family with us,” says Amy.

Not far into their TV program, Amy noticed light reflecting in their stained-glass front door, but thought it was from the fire. At that very moment, she said, the smoke detectors started blaring.

“I realized then the flames were in the window of our attached garage. Spence ran to the door that leads to the garage to find smoke billowing from the top of the door and began shouting, “Everyone out! Everyone out!’”

Watching it burn

They left with only the clothes on their backs and their cell phones. “We didn’t even have shoes on. Kirby had Mac wrapped in a blanket and Jake leashed the dog. Thankfully, everyone got out safely,” Amy recounts.

It was 8:11 p.m. when the call was made to the fire department. The Wagners stood across the street in their neighbors’ front yard as a window exploded and flames rose into the air.

“Spence was going to try to move the cars away from the house, but by the time he got to the edge of our driveway, the garage doors collapsed and engulfed our cars. It happened so fast.”

In a few moments, deputy sheriffs and numerous fire departments arrived, and several hours later the fire was out and the investigative team entered the house to search for the cause. The conclusion was that faulty wiring in the inner wall of the garage likely started the fire.

Feeling the love

With no home to go back to, neighbors took in Spence and Amy. Jake and his family stayed with his brother Luke. Although they had someplace to stay, they didn’t have any essentials like shoes, coats, toothbrushes, combs, etc. “There is nothing in my experience more humbling than to have everything you need one moment and then gone the next,” Amy recalls.

With no home to go back to, neighbors took in Spence and Amy. Jake and his family stayed with his brother Luke. Although they had someplace to stay, they didn’t have any essentials like shoes, coats, toothbrushes, combs, etc. “There is nothing in my experience more humbling than to have everything you need one moment and then gone the next,” Amy recalls.

The Wagners were fortunate to have an outpouring of support from their neighbors and community, making the next few weeks easier. Their generosity gave them shelter, transportation, meals, clothing, and other basic necessities.

“We recognized how lucky we were. When you are devastated in this way, it is difficult to even know what you need. You’re a little numb from the experience, but people rallied to help us get on our feet.”

The aftermath: Picking up the pieces

The Wagners have their home insurance with Member Benefits. Bob Manor, Senior Claims Specialist, handled their claim. (Bob retired in August 2022 after 25 years with Member Benefits.) “Bob met with us within a day or two of the fire. He was always just a phone call away to answer any of our questions. He worked with us and the claims adjuster to put our home and lives back together. When there were bumps in the road, Bob was on it to get things resolved as quickly as possible. He was great to work with,” says Amy.

The Wagners have their home insurance with Member Benefits. Bob Manor, Senior Claims Specialist, handled their claim. (Bob retired in August 2022 after 25 years with Member Benefits.) “Bob met with us within a day or two of the fire. He was always just a phone call away to answer any of our questions. He worked with us and the claims adjuster to put our home and lives back together. When there were bumps in the road, Bob was on it to get things resolved as quickly as possible. He was great to work with,” says Amy.

“All fire claims are so hard. People don’t realize the emotional toll an event like this takes,” Bob said. “It’s really not just about putting your house back together, it’s dealing with the grief of all that’s lost, the lack of normalcy, and the stress of working through it all. As a claims adjuster, my job is not just paperwork. It’s also about understanding the trauma the member has experienced and providing emotional support while trying to restore their lives as quickly as possible.”

The home was considered a total loss and the Wagners had to rebuild. They were officially with no fixed abode. They stayed with their neighbors for a week but needed more permanent housing while their home was demolished and then rebuilt. This proved difficult because of the pandemic shutdown.

Amy adds, “We finally found an Airbnb in the community adjacent to our hometown. We were in this location from Memorial Day 2020 until we moved into our new home in March of 2021.”

Out of the ashes comes something good

The Wagners knew their lives would never be the same and felt they couldn’t just move back into their home and let things end there. Amy explains, “We both really believe in paying it forward. We learned so much from our experience that we really believed we were in a good position to help others who go through the same thing. “

The idea of paying it forward materialized into the creation of the Wagner Family Fire Fund (The Fund). Its sole purpose is to provide immediate assistance to families in Kenosha County who lose their home to a fire.

The idea of paying it forward materialized into the creation of the Wagner Family Fire Fund (The Fund). Its sole purpose is to provide immediate assistance to families in Kenosha County who lose their home to a fire.

“There’s no guide book telling you what to expect when you lose your home to fire,” Amy states. “Through The Fund, we can offer relief the day of the disaster, assistance throughout the rebuilding process, and that sense of community that we were so lucky to have.”

With the help of fire departments in their area, they distribute “go bags” to individuals or families who are displaced by a house fire. The go bags contain all the things the Wagners needed immediately after the fire: shampoo, conditioner, body wash, comb, brush, deodorant, toothbrushes and toothpaste, gift cards to area restaurants for meals, a two night stay at Country Inn & Suites, gift cards for clothing and other essentials, socks, a mental health kit, coloring books and crayons, and a guidebook they created, which is set up like a step-by-step workbook.

“When our fire fund kicked off on August 28th of 2021, we raised enough money to provide go bags to the fire houses in western Kenosha County. Within a week of our kick off, we had a bag go out to a family,” Amy says. “We recently held our first anniversary fundraiser in Bristol featuring food, beer and wine, a silent auction, kids’ games, and more.”

“When our fire fund kicked off on August 28th of 2021, we raised enough money to provide go bags to the fire houses in western Kenosha County. Within a week of our kick off, we had a bag go out to a family,” Amy says. “We recently held our first anniversary fundraiser in Bristol featuring food, beer and wine, a silent auction, kids’ games, and more.”

Other fundraising efforts came from a Safe Quarters campaign in area schools where students collected quarters for their fund, and from Antioch Pizza in Paddock Lake where they received 10% of proceeds from a day’s sales. Texas Roadhouse in Kenosha is hosting another fundraiser on October 20th.

Amy and her family are looking to do more good in the future. “The Wagner Family Fire Fund now covers all of Kenosha County. Eventually, we hope to get to a point where we can provide help to renters who are displaced by fire. We are working our way there.

“We’ve made a lot of progress in a short time with The Fund, and with such a supportive community, we are confident we will be able to help more people through the trauma of a fire.”

Profile

Members Amy and Spence Wagner have been married for 36 years. They have five grown children and five grandchildren. “We are a very close-knit family,” Amy says. A recently retired teacher, she taught reading and language arts at Bristol school for 18 years. Amy also taught speech communications, was involved with the gifted and talented program, coached the speech team, directed the school play, headed up the English Festival, and served as a union rep. Spence works in wholesale produce sales.

Leatrice’s Legacy

Fifty years ago, public educators in Wisconsin gained access to programs that would be instrumental in securing their financial future.

What is known today as WEA Member Benefits—with its broad array of financial education, services, and products—began operation in 1972 with a single program that was based on a big idea: that public educators deserved to be financially secure and that the value they brought to our communities should be reflected in programs that protected and empowered them financially.

We will celebrate that milestone—a half century of serving Wisconsin public school employees—throughout 2022 with some “where are they now” stories of members who have been featured in your$ magazine since we began publishing it in 2009. In visiting with them again, you’ll learn how their lives have changed, what challenges and successes they have had, and what role Member Benefits has played in their journey toward financial security.

Passing the torch: A legacy of education and financial security

Leatrice Jorgensen’s story has been a favorite, and it seems appropriate to start this year of celebration and reflection here because it’s a story rich with a passion for learning and teaching, tradition, and connection to the early days of Member Benefits.

It was 2010 when we sat with Leatrice at her kitchen table flanked by her daughter and granddaughters. The table, she said, was a gathering place for family fun and making memories. It was also a place for learning, counseling, and legacy building.

Leatrice caught our attention when she called asking for 403(b) enrollment forms to be sent to her granddaughter Amanda, who was a new teacher. This was the second time Leatrice had made this call. The first was when Amanda’s older sister Lea started teaching several years earlier. The goal was to have both granddaughters start saving for retirement right out of the gate. She knew from experience the significance of this decision and what it could mean for their financial future.

Leatrice first opened her 403(b) account (what was then called a tax-sheltered annuity account) in 1981 when the WEA TSA Trust consisted of just a guaranteed or “fixed” investment and the interest rates were high. “I think I’m going to get into that,” she told us she had announced to her husband at the kitchen table. “He wasn’t so sure.” But Leatrice felt she needed to get started right away and opened an account. Her intuition paid off. “We did quite well,” Leatrice reported.

The more things change

Of course, a lot has changed since she opened her account. Today, the financial products and services offered by Member Benefits have expanded to include the option for mutual fund investment, Roth savings, IRA accounts, and financial planning services. There is even a nonretirement savings account option. Additionally, over the decades there have been changes in economic conditions, the financial regulatory environment, and the technology that drives it all.

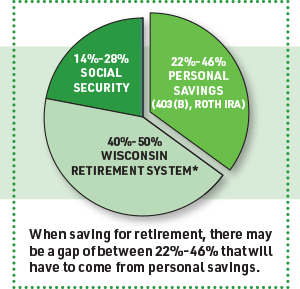

What hasn’t changed, however, is the need to save. In fact, saving is more important than ever. For many public school employees, it’s likely that their state pension and Social Security will not be enough to cover living expenses in retirement.

And, concepts like the time value of money and compound interest haven’t changed either. Leatrice knew that starting early would give her granddaughters an edge because they have time on their side. She was right.

The story continues

Eleven years later in 2021, we pick up Leatrice’s story at the same kitchen table where Amanda, Lea, and Patti are gathered. The kitchen is unchanged, but there is an empty chair. Leatrice passed away in 2016. She was a breast cancer survivor, her daughter Patti says, but succumbed to ovarian cancer in 2016.

For Amanda, Lea, and Patti, life has marched on, but the memory of Leatrice and what she taught them is ever present in their lives.

Amanda

Amanda Gabryszek is now in her thirteenth year at Bay Port High School in Howard Suamico. She teaches culinary arts classes. “I truly love it,” Amanda says. Leatrice dubbed Amanda the family gardener and chef because she used grandma’s kitchen to try out new recipes for the family and the classroom. “Grandma’s kitchen is still the test kitchen, and we gather here for holidays and weekend fun.”

Amanda acknowledges her Grandma’s influence is evident in many aspects of her life, even in the classroom. “I talk about her to my students when I’m teaching certain skills or recipes. For instance, she taught me how to make pie crust. At Thanksgiving, I got to roll out the leftover dough scraps to make mini-pies. I share this tradition with my students so they can see how something so small can have a huge impact in your life.”

Each year, her students do an activity around the importance of their journey with food—how their family eats, how it impacts them, and recipes their family values. “We talk about money, too: budgeting, grocery shopping, and costing ingredients,” she says.

Financially…

Amanda continues to contribute to her 403(b) and plan for her future. “I followed Grandma’s advice. She wanted us to learn to live and support ourselves while saving for the future. It feels great to be able to do that!”

Most important financial decision since 2009

Increasing her 403(b) contribution each time she got a raise or payment for extra duty. Increasing contributions when your salary goes up was one of the strategies Leatrice implemented and preached. “That was always Grandma’s best advice on financial planning!”

This was great advice from Leatrice. She knew that it’s the little things in life that can make the biggest difference.

Greatest financial challenge

Understanding finances with a spouse. She married her husband Chris two years ago and concedes it took some adjusting to the new dynamic. “I didn’t really think about it too much until we were making decisions like purchasing a house, combining bills, and such.” But they are figuring it out together—the day-to-day and the long-term planning for retirement. “We are mindful about where our money goes in our giving, spending, and saving.” Leatrice would approve.

Lea

Lea Hanke taught 4th grade then switched to 7th grade health at Marshfield Middle School before deciding to take a break. “With three daughters, ages 6, 3, and 6 months, life is much different now,” Lea says. “I decided this summer to step away from teaching for now. I really want to be there fully for my girls,” she says. “I hope to expose them to a wide range of things and experiences like Grandma did for me.”

The decision to take a break was not an easy one for Lea and her husband. “My salary increased greatly in the past 11 years with the completion of my Master’s degree and additional professional development opportunities, so to give that up was a huge decision,” she says.

Parenting is emotionally rewarding and fulfilling, but leaving the workforce to be a stay-at-home parent, as Lea suggests, generally has some financial implications for the family budget and long-term financial plans. It not only means loss of income but also other benefits, including access to your employer’s retirement savings plan or pension, loss of contributions and years of credits to Social Security benefits, and missed opportunities for career advancement.

This doesn’t mean that staying at home to care for your kids is wrong or impossible, nor should it be discouraged. The key is to understand what it means for you and plan for it.

Financially…

Like Amanda, Lea also heeded her grandmother’s advice to increase contributions to savings. “I contributed and increased my 403(b) contributions like Grandma wanted me to when my pay increased,” Lea says.

As Leatrice explained it, “You didn’t have that money before and were able to live without it, so redirecting it to savings right away is an easy way to pay yourself first.”

Greatest financial challenge

Trying to budget during the summer months. “I didn’t have the option to get paychecks over the summer, so it was a struggle. We always had more time to do things but not as much money to do them and still pay our bills.”

Greatest financial decision

Stepping away from teaching to care for her three young daughters. “We know the decision will impact the long-term plan, and it may mean our retirement may not be as soon as we had hoped, but we felt it was the best choice for our family at this time.”

Patti

Teaching is also on the resume of Leatrice’s daughter, Patti Hilger. She taught 4th, 5th, and 6th grades in the Merrill School District for eight years. She loved teaching, but like Lea, she quit to raise her girls. A tough decision but not one she regrets.

Patti fondly recalls the atmosphere of learning her mother created for the family. “Learning was continuous in our home. My earliest recollections of Mom are watching her sit at the kitchen table each morning to plan her day, study and plan her lessons, pay her bills, and talk over life.”

Leatrice’s decision to open and fund a 403(b) account not only provided Leatrice with additional income in retirement, but continues to provide a source of income for Patti and her sister.

“We now receive the required minimum distributions each year from Mom’s account. Mom knew enough to place every raise she received into her 403(b) and promoted the program all of her days. She also took advantage of workshops offered and shared what she learned with fellow educators. Our girls both listened and direct their raises into their accounts, and my husband and I do the same in our retirement plan at our business. But I didn’t heed her advice during my teaching years and I still regret it,” Patti says. “Mom had the wisdom and knowledge to allow her money to work for her throughout her seasons of life. And we are benefiting from that wisdom.”

Patti describes Leatrice as a loving, energetic, fun-loving, hardworking, dedicated, compassionate woman. “She stepped out of her comfort zone throughout her life and became somewhat of a trailblazer for women. She felt strongly about the need to get a quality education for children and herself.”

When Leatrice became ill, Patti stepped in as caregiver. “Mom was a great patient and we laughed and enjoyed our time together to the end. Her middle name was ‘Joy’ and she truly was a joy. I am grateful for the time I spent with her and encourage others to choose to care for their parents whenever possible.”

Leatrice left her family a legacy of learning and teaching, love and caring, and wisdom that by all accounts has the momentum to benefit generations to come.

Get more of the story!

Read the original story about Leatrice and how her passion for learning and teaching was passed down the generations. View the Fall 2010 magazine (online or PDF).

Ready to save more?

Enroll in our 403(b) or IRA retirement savings programs by visiting our website or calling 1-800-279-4030.