Model portfolios are offered to Wisconsin residents.

Choose your strategy

Carefully chosen no-load mutual funds and the Guaranteed Stable Investment* provide you with the flexibility you need to manage risk and build a diversified portfolio. And you can choose how involved you want to be in managing your investments.

Before you consider any investment, it is important to understand risk and to determine your risk tolerance. Our Investor Suitability Profile Questionnaire will help you assess your tolerance for risk as an investor.

Plug-and-play investing

For those who prefer not to manage their own investments, Member Benefits has two easy options: target retirement funds and model portfolios.

Target retirement funds: One-decision investing

Target retirement funds meet the needs of investors who don’t have the ability, interest, or time to monitor their retirement account portfolio’s asset allocation. More about target retirement funds.

Model portfolios: Personalized portfolios that are managed for you

Model portfolios give you the ability to build a personalized portfolio that’s more comprehensive than the target retirement funds, but still doesn’t require a ton of time selecting and managing individual investments. More about model portfolios.

Hands-on investing

For investors who prefer to play an active role in monitoring and managing their investments, our lineup of mutual funds and the Guaranteed Stable Investment* may be more appropriate.

Use our Investment Fund Comparison Tool for side-by-side comparisons of funds from the same investment categories. The most current month-end performance data for each fund is available through Morningstar fund analysis.

Keep in mind that mutual fund investments are not guaranteed and may gain or lose value. Past performance is no guarantee for future results. Future performance may be lower or higher than past performance.

Before investing in any mutual fund, download a prospectus below or call WEA Member Benefits at 1-800-279-4030 to request a prospectus. We advise you to read it carefully and consider the fund’s investment objectives, risks and charges and expenses carefully before investing. The prospectus contains this and other information about the investment company.

*Interest is compounded daily to produce a yield net of Empower’s administrative fee of 0.60%. Empower Annuity Insurance Company (EAIC) is compensated in connection with this product by deducting an amount for investment expenses and risk from the investment experience of certain assets held in EAIC’s general account. For more information, go to weabenefits.com/empower.

For investors who prefer to play an active role in monitoring and managing their investments, our lineup of mutual funds and the Guaranteed Stable Investment* may be more appropriate. Before you consider any investment, it is important to understand risk and to determine your risk tolerance. Our Investor Suitability Profile Questionnaire will help you determine your risk tolerance.

View our funds on our Investment Fund Comparisons page.

View our quarterly performance report.

Investment categories include:

- Fixed income investments

- Target retirement funds

- Large-cap stock funds

- Mid-cap stock funds

- Small-cap stock funds

- International stock funds

- Specialty funds

*Interest is compounded daily to produce a yield net of Empower’s administrative fee of 0.60%. Empower Annuity Insurance Company (EAIC) is compensated in connection with this product by deducting an amount for investment expenses and risk from the investment experience of certain assets held in EAIC’s general account. For more information, go to weabenefits.com/empower.

These products and services are offered to Wisconsin residents.

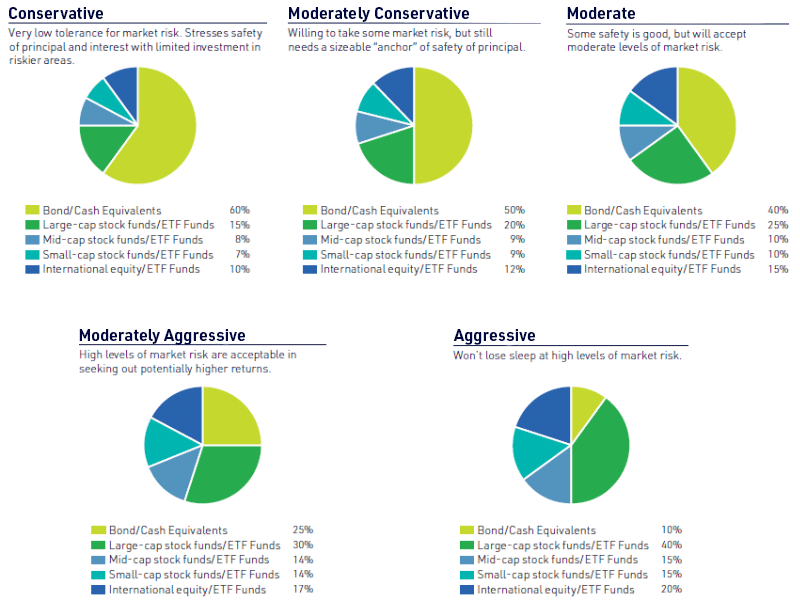

Model portfolios

Personalized portfolios that are managed for you

Model portfolios give you the ability to build a personalized portfolio that’s more comprehensive than target retirement funds, but it doesn’t require a ton of time selecting and managing individual investments.

A model portfolio is a predefined investment portfolio based on your age, risk tolerance, and your retirement timeline.

Model portfolios can help you achieve your personal investment goals by placing you in one of five predefined portfolios based on the results of your Investor Suitability Profile Questionnaire, which helps you assess your tolerance for risk.

Members who choose to invest in a model portfolio will need to take the Investor Suitability Profile Questionnaire when they initially invest and then again every three years to determine if there are any changes in their risk tolerance and investment goals.

The investments that make up the model portfolios are selected from pre-vetted mutual funds offered by Member Benefits.

Features include:

- Requires a small investment of time.

- Low maintenance.

- No additional fees to invest in a model portfolio.

- Auto-rebalances each year so your investment mix aligns with your investment goals.

- A Investor Suitability Profile Questionnaire is required initially and then again every three years.

- Because this is a managed fund option, you cannot mix a model portfolio with other investments in our fund lineup.

View and compare all investment choices.

Model Performance

The reported performance of the models is hypothetical yet based on actual performance of the underlying mutual funds and their corresponding weightings. The performance data on the underlying funds was derived from Morningstar®, an independent third party. The illustration does not reflect the actual performance of individual investors in the models. Investment models are not FDIC-insured, and they are not bank-guaranteed. Investment models may lose value. Past performance is no guarantee of future results. Model performance returns illustrate the relationship between risk and reward. The WEA Member Benefits model portfolios are risk-based. The more conservative the underlying asset weightings are, the lower the expected rate of return. Because of market changes, the makeup of your actual account portfolio will not exactly match the model portfolio. We may perform periodic adjustments of the model portfolio investments and rebalancing of your account to more closely match the model portfolio you select.

Model portfolios are developed by WEA Financial Advisors, Inc., (WEA FA) under the oversight of the WEA Member Benefits Investment Committee. Model portfolios may be adjusted at the discretion of WEA FA and the Investment Committee with prior notice to you. From time-to-time there may be extraordinary situations that will warrant more scrutiny when making adjustments. An example is the market downturn in October 2008. Although WEA FA carefully evaluates the makeup of the portfolios on a regular basis, we make no representation regarding the likelihood or probability that any or all of the portfolios will in fact achieve a particular investment goal or fulfill the risk tolerance profile as described for each portfolio. As a self-directed investor, you should carefully consider the merit and appropriateness of the available investments under your district’s retirement plan in light of your own personal financial circumstances, including your other assets, income, investments, and/or cash flow needs.

Re-Assess Your Investment Needs Regularly

Because your needs, goals, portfolio, and situation may change over time, be sure to re-evaluate your investment strategy at least once a year. You can always choose a different model or create your own mix. Redemption fees may apply. When participating in a WEA Member Benefits model portfolio, you must complete the Risk Profile Questionnaire every three years. You may not continue to use the model portfolio option if you do not timely complete a Risk Profile Questionnaire. In such an event, and if we receive no other instruction from you, your plan assets will be moved to your plan’s QDIA (qualified default investment alternative).

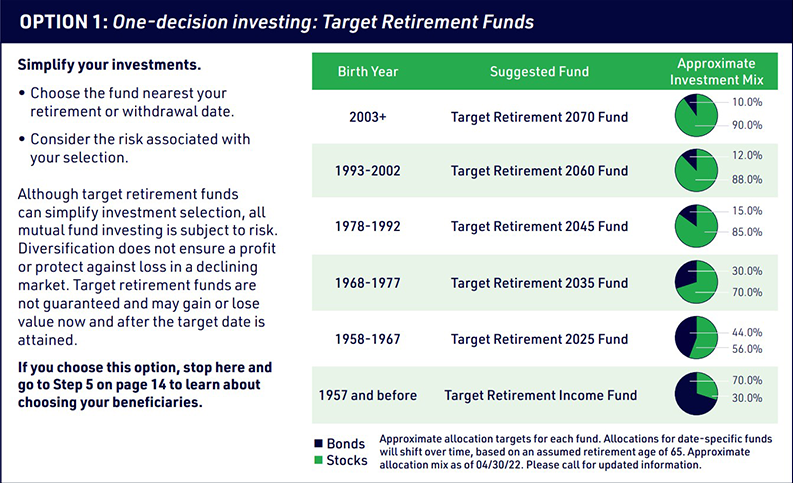

Target Retirement Funds

One-decision investing

Target retirement funds* meet the needs of investors who don’t have the ability, interest, or time to monitor their retirement account portfolio’s asset allocation.

Managing your own investments can be an overwhelming and time-consuming business, requiring regular monitoring and rebalancing to make sure your investments are meeting your investment objectives.

But not everyone has the time or desire to be actively involved in managing their investments. That’s why we have included target retirement funds as an investment option. These funds identify and maintain an age-appropriate asset allocation throughout your investing years—so you won’t have to think about it until you’re ready to make withdrawals in retirement.

- Select your retirement date.

- Select your fund.

- Get on with your life.

Before investing in any mutual fund, call WEA Member Benefits at 1-800-279-4030 to request a prospectus. We advise you to read it carefully and consider the fund’s investment objectives, risks, and charges and expenses carefully before investing.

See all investment choices.

*Although Target Retirement Funds can simplify investment selection, all mutual fund investing is subject to risk. Diversification does not ensure a profit or protect against loss in a declining market. Target retirement funds invest in a mix of stock and bond funds that steadily become more conservative as they approach their target date. The principal value of a target retirement fund is not guaranteed and may gain or lose value now and after its target date.

Created by educators

WEA Member Benefits

Over 50 years ago, we were created by Wisconsin educators for Wisconsin educators. No other financial organization can say this. Explore our unique programs and services.