“Start putting money away for retirement, even if it’s a small amount. Retirement will be here before you know it.”

The 403(b) is a great way for public employees to save for retirement. It’s similar to the 401(k) offered in the private sector.

Our 403(b) program has been nationally recognized by Forbes magazine and the Los Angeles Times as a low cost, soundly managed retirement savings option for Wisconsin public school employees.

Do you have ALL the pieces in place for a secure retirement?

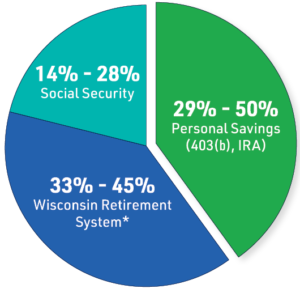

As a Wisconsin public school employee, you need WRS, Social Security, AND personal savings for your retirement plan to be complete. Put your whole plan in place with a 403(b) from Member Benefits.

- One piece of the pie is your retirement income from the Wisconsin Retirement System (WRS) (33-%–45%).

- The second piece is your Social Security benefit (14%–28%).

- The third piece is YOUR personal savings. Investing in a 403(b) can help you fill any shortfall in your retirement income. Retirees are living longer and are more active in retirement, so personal savings is becoming increasingly important—accounting for up to 50% of your retirement income needs.

Get our 403(b) enrollment guide

*Sources of retirement income for most Wisconsin public school employees. *The percentage of salary replaced is tied to how many years one works in state service. The 33%-45% figure assumes 25-33 years of WRS service and depends on individual circumstances.

Roth vs Traditional

403(b) contributions can be before-tax or Roth (after-tax) or a combination of the two.

Roth contributions are taxed now, but qualified withdrawals, including earnings, are tax-free. When you retire, you owe nothing on years of compounded earnings which may be a significant amount.

Before-tax (traditional) contributions reduce your taxable income and payment of the taxes is deferred until you withdraw the money. Withdrawals are taxed as ordinary income.

What is a Roth 403(b) and how is it different from a Traditional 403(b)?

Roth contributions are after-tax, which means you pay taxes now on your contributions, but all qualified* withdrawals, including earnings, are tax-free.

This is different from 403(b) contributions that are made on a before-tax basis. Before-tax contributions reduce your taxable income and defer taxes until you withdraw the money.

So the question is, do you want to pay the taxes on your contributions now or when you retire?

*For qualified withdrawals from the Roth 403(b), the participant must be age 59½ or older and have had the account for at least five years.

What is the benefit of after-tax savings?

One of the greatest benefits of Roth savings is the ability to reduce your tax liability in retirement.

For decades, the assumption has been that most people would be in a lower tax bracket in retirement and thus would benefit from before-tax savings. However, changes in tax policy, including lower tax rates, the taxation of Social Security, and other deductions available under the tax code, increase the chances that you could be in the same or higher tax bracket when you retire.

These changes mean that before-tax savings alone may not be the optimal tax strategy in every situation.

What does this mean to me?

In retirement, Wisconsin public school employees typically have at least three sources of income: the Wisconsin Retirement System, Social Security, and individual retirement savings. All are taxable as ordinary income in retirement. Any tax savings realized today could be more than offset by a higher tax bill in retirement.

How can I start making Roth 403(b) contributions?

WEA Member Benefits offers the Roth feature to its plan sponsors (employers). However, districts are not required to offer the Roth 403(b) feature in their plan, so check with your employer to see if they offer this feature. Current participants whose employer offers the Roth 403(b) need to complete a new Salary Reduction Agreement (SRA) and choose investment allocations for their Roth contributions. If you do not have a 403(b) account with Member Benefits, you will need to complete an enrollment application as well.

Moving money from one account to another is referred to as a transfer, rollover, exchange, or conversion. It’s important to understand your options for moving and managing your money to maximize your retirement savings within your account(s). We accept funds from 401(k), 403(b), 457, IRA, and other retirement accounts.

Move moneySee our program costs listed below. Our costs are much lower than the 403(b) industry average of 1.00%*.

| 403(b) Balance | Administrative Cost | Administrative Cost in Dollars |

|---|---|---|

| $0 to $150,000 | 0.28% | $2.80 per thousand |

| $150,001 to $300,000 | 0.25% | $420 on the first $150k plus $2.50 per additional thousand |

| $300,001 to $450,000 | 0.20% | $795 on the first $300k plus $2.00 per additional thousand |

| $450,001 to $600,000 | 0.10% | $1,095 on the first $450k plus $1.00 per additional thousand |

| $600,001 to $750,000 | 0.05% | $1,245 on the first $600k plus $0.50 per additional thousand |

| above $750,000 | 0.01% | $1,320 on the first $750k plus $0.10 per additional thousand |

An annual minimum account cost of $25 applies to all accounts. The minimum is waived for all accounts with active

contributions.

Mutual fund management and redemption costs may apply. See Investment Spectrum.

*2022 GAO Survey

How can you keep your money working for you in retirement?

yourINCOME PATH™ can help!

yourINCOME PATH is the suite of options and support we offer to help turn your retirement savings account balance into income during retirement.

We offer several income management options to fit your unique goals and needs during retirement. And Member Benefits provides these services at no additional cost.*

Visit the yourINCOME PATH page to read more about the program and review retirement income management strategies, then learn how to get started on your own income strategy.

Member Benefits is here for you to and through retirement.

Learn more about yourINCOME PATH

*If you choose to invest in the WEA Tax Sheltered Annuity or WEA Member Benefits IRA program, fees will apply. Consider all expenses before investing.

Because we are a member organization, our 403(b) program is designed with unique qualities that set us apart from other commercial providers.

Low costs

Low administrative costs that keeps more of your money working for you. The power of group purchasing keeps plan costs low.

- Low administrative cost based on your account balance. Our costs are further explained on our 403(b) costs page.

- No-load mutual funds

- No transfer cost

- No surrender penalties or withdrawal charges

An annual minimum cost of $25 applies. This minimum is waived for accounts with active contributions during the year.

Member focused

- We operate as a trust which reinvests any profits back into programs that benefit participants.

- We exclusively serve public education employees.

- No commissions are paid to Member Benefits staff.

- We have no shareholders.

Investment choices

No-load mutual funds, representing a wide range of asset classes, and our Guaranteed Stable Investment provide the flexibility you need to manage risk and build a diversified portfolio.

See more about investment strategies.

Personal service and consultations

When you call us, you will talk to a live person. Our experienced consultants will take the time to help you develop a plan that is right for you. Schedule a personal phone consultation at a time convenient for you.

Access 24/7

Access your account online.Created by educators

WEA Member Benefits

Over 50 years ago, we were created by Wisconsin educators for Wisconsin educators. No other financial organization can say this. Explore our unique programs and services.